B2B LEAD GENERATION FOR VIRTUAL CARE PLATFORMS

Double Your Pipeline With Benefit Consultants & Employers Who Actually Close

We deliver 100–750+ qualified appointments annually with benefit consultants, HR leaders, and self-funded employers who are actively building their virtual care networks - so you can focus on expanding market share, not chasing leads.

$765M+

PIPELINE VALUE GENERATED

1.2 M+

EMAILS SENT PER MONTH

10.2K+

LEADS GENERATED

94%

CLIENT SATISFACTION

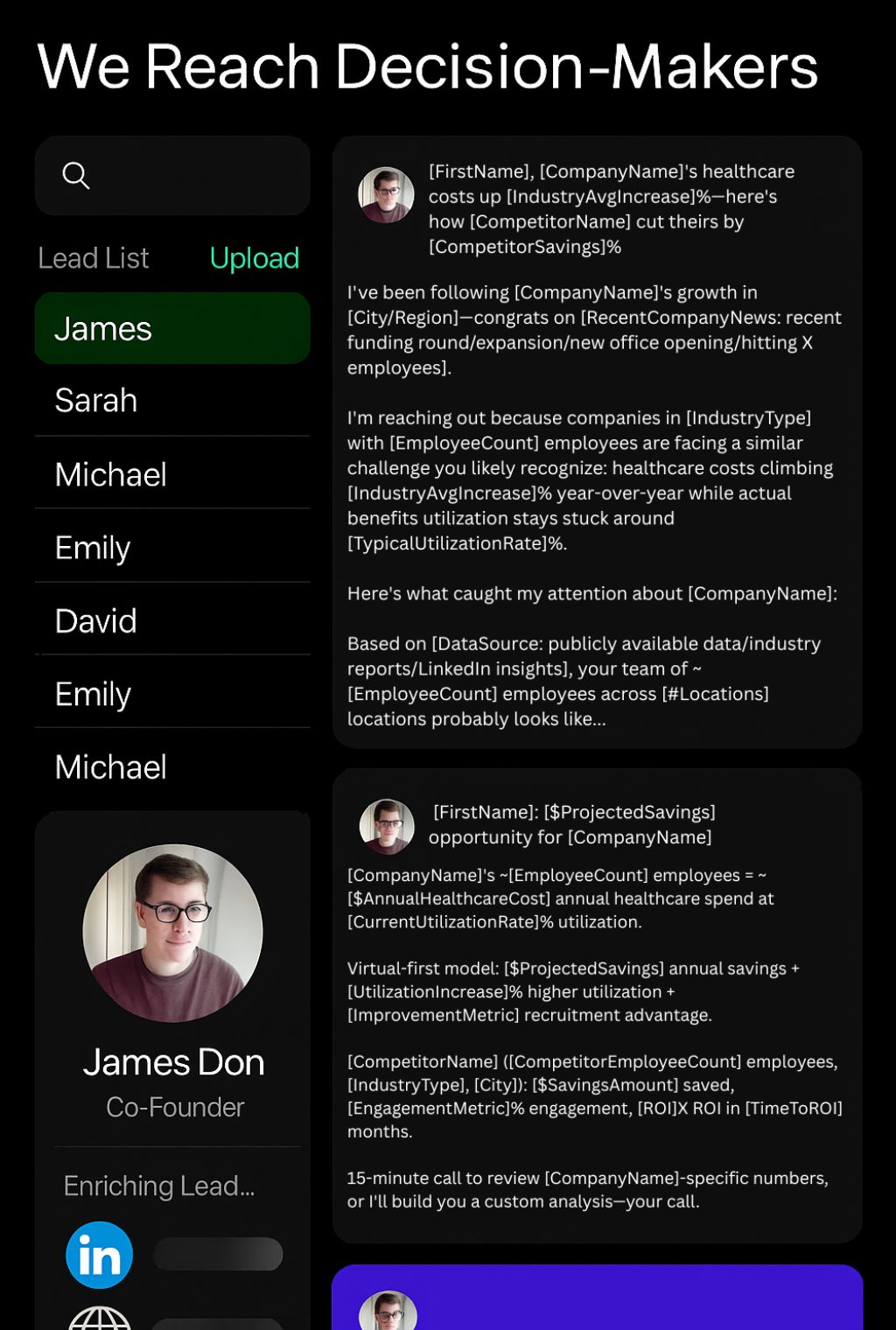

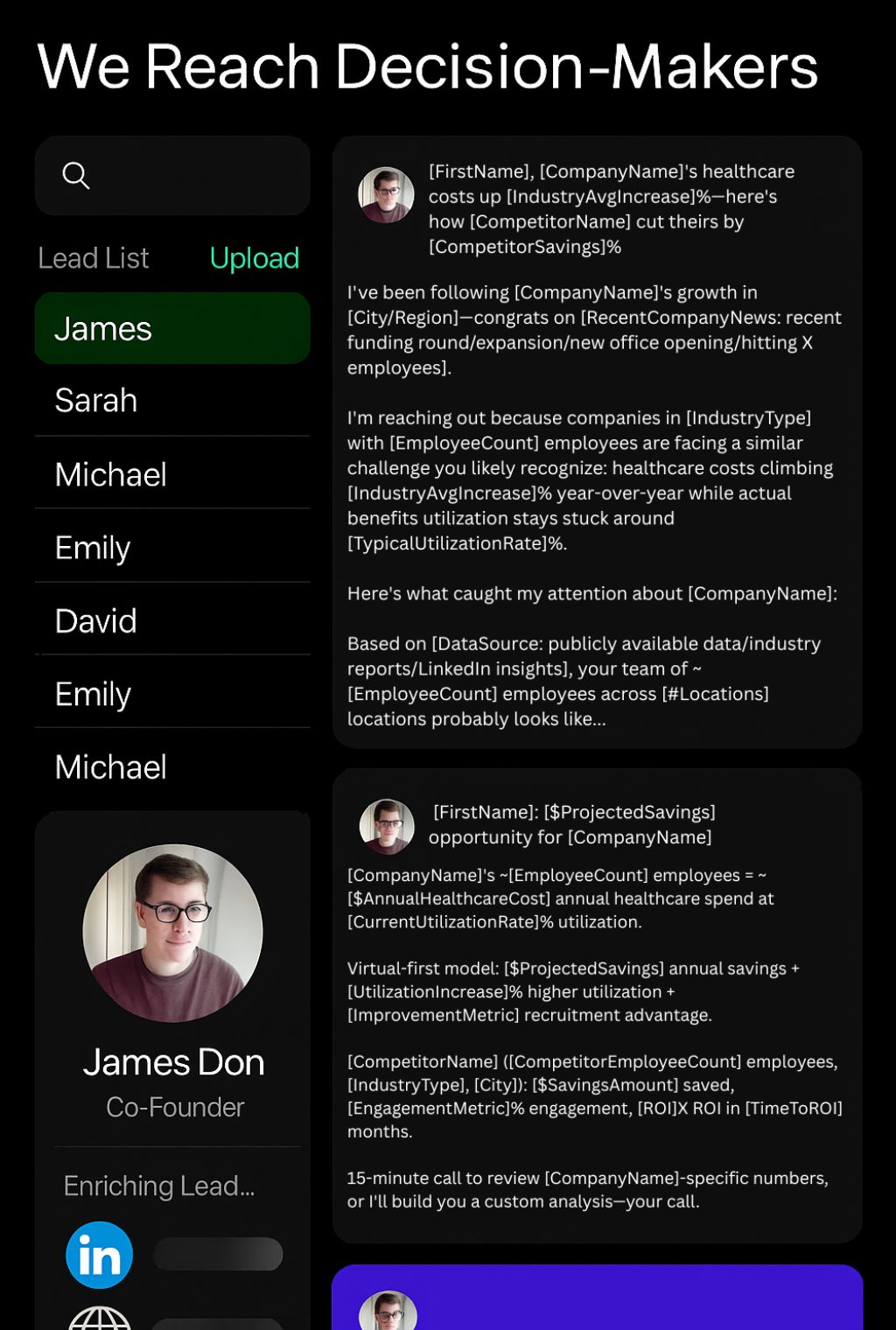

We Reach Every Decision-Maker In Your Market

If they're buying virtual care benefits, we'll reach them.

Winning market share means reaching every benefits decision-maker who matters - not just the ones in your CRM. We identify and engage every benefit consultant, HR leader, and self-funded employer in your addressable market.

Decision-Makers We Reach

Employee Benefits Consultants

HR Leaders & Benefits Managers

Self-Funded Employer CFOs & HR VPs

Third-Party Administrators

Professional Employer Organizations

We Reach Every Decision-Maker In Your Market

If they're buying virtual care benefits, we'll reach them.

Winning market share means reaching every benefits decision-maker who matters - not just the ones in your CRM. We identify and engage every benefit consultant, HR leader, and self-funded employer in your addressable market.

Decision-Makers We Reach

Employee Benefits Consultants

HR Leaders & Benefits Managers

Self-Funded Employer CFOs & HR VPs

Third-Party Administrators

Professional Employer Organizations

Your Prospects Already Know About Virtual Care Give Them a Reason to Engage

Brokers field a dozen virtual care pitches every week. HR teams are buried in vendor outreach.

Generic emails about "transforming employee health" get deleted without a second thought. Our campaigns cut through by speaking the language of claims data, utilization rates, and commissions.

We don't lead with your platform's "features" - we lead with the business outcomes your prospects are measured on. Relevance drives replies.

Your Prospects Already Know About Virtual Care Give Them a Reason to Engage

Brokers field a dozen virtual care pitches every week. HR teams are buried in vendor outreach.

Generic emails about "transforming employee health" get deleted without a second thought. Our campaigns cut through by speaking the language of claims data, utilization rates, and commissions.

We don't lead with your platform's "features" - we lead with the business outcomes your prospects are measured on. Relevance drives replies.

While Your Current Agency Is "Figuring It Out",

Competitors Are Locking Up Broker Networks

Virtual care platforms face pipeline challenges that generic "marketing agencies" can't solve. Every quarter without new opportunities is market share your competitors are claiming.

These are the challenges we solve:

Your last agency was a complete disaster

Zero qualified meetings. Missed deadlines. Generic campaigns that got ignored. No strategy, just spam. You know outsourcing can work - you just need a partner who actually knows what they're doing.

Broker networks are impossible to penetrate

You're stuck relying on a handful of broker relationships while competitors lock up entire regional networks. Building new broker partnerships takes 6–12 months of relationship-building you don't have time for.

You have no unified go-to-market strategy

Post-merger, you've got three sales teams working three different markets with zero coordination. Meanwhile, your newly expanded footprint is an opportunity competitors are exploiting faster than you can integrate.

Your growth is reactive, not repeatable

You close deals when inbound gets lucky or a rep has a good quarter. But there's no system. No predictable pipeline. No way to forecast with confidence. Your board wants to see 150% YoY growth, but you can't manufacture opportunities on demand.

You're executing tactics without a strategy—and it shows

Marketing runs campaigns. Sales makes calls. But there's no cohesive plan connecting activity to revenue. You're spending budget on tools, content, and agencies that don't move the needle because no one owns the full go-to-market strategy. Meanwhile, pipeline stays flat.

Revenue has flatlined and no one knows why

You hit your number two years running. Now you're stuck. The same strategies that got you to $10M aren't getting you to $25M. Your TAM is huge, but pipeline isn't growing. You need a new motion—one that systematically unlocks untapped market segments.

How We Fill Your Pipeline

With Benefit Consultants & Employers

Purpose-built outbound for virtual care platforms competing in complex B2B healthcare markets.

Benefit Consultant & Employer Fluency

Our campaigns speak the language of total rewards strategies, employee utilization metrics, and broker revenue models. We don't pitch "innovative healthcare solutions" - we lead with ROI benchmarks, claims cost reduction data, and broker partnership economics. Your prospects reply because we sound like someone worth talking to.

First Meetings Within 60 Days

We launch campaigns within 30 days. By day 60, you'll have qualified meetings on your calendar with benefit consultants and employers actively evaluating virtual care solutions. No 190-day "ramp periods." No endless testing phases. Just pipeline.

Vertical Expertise in Benefits & Virtual Care

We don't work across "50+ industries" - we specialize in member-based virtual care. Our team understands benefit plan design, broker distribution models, and employer buying cycles. We've filled pipelines for platforms like yours, so we know what works and what wastes time.

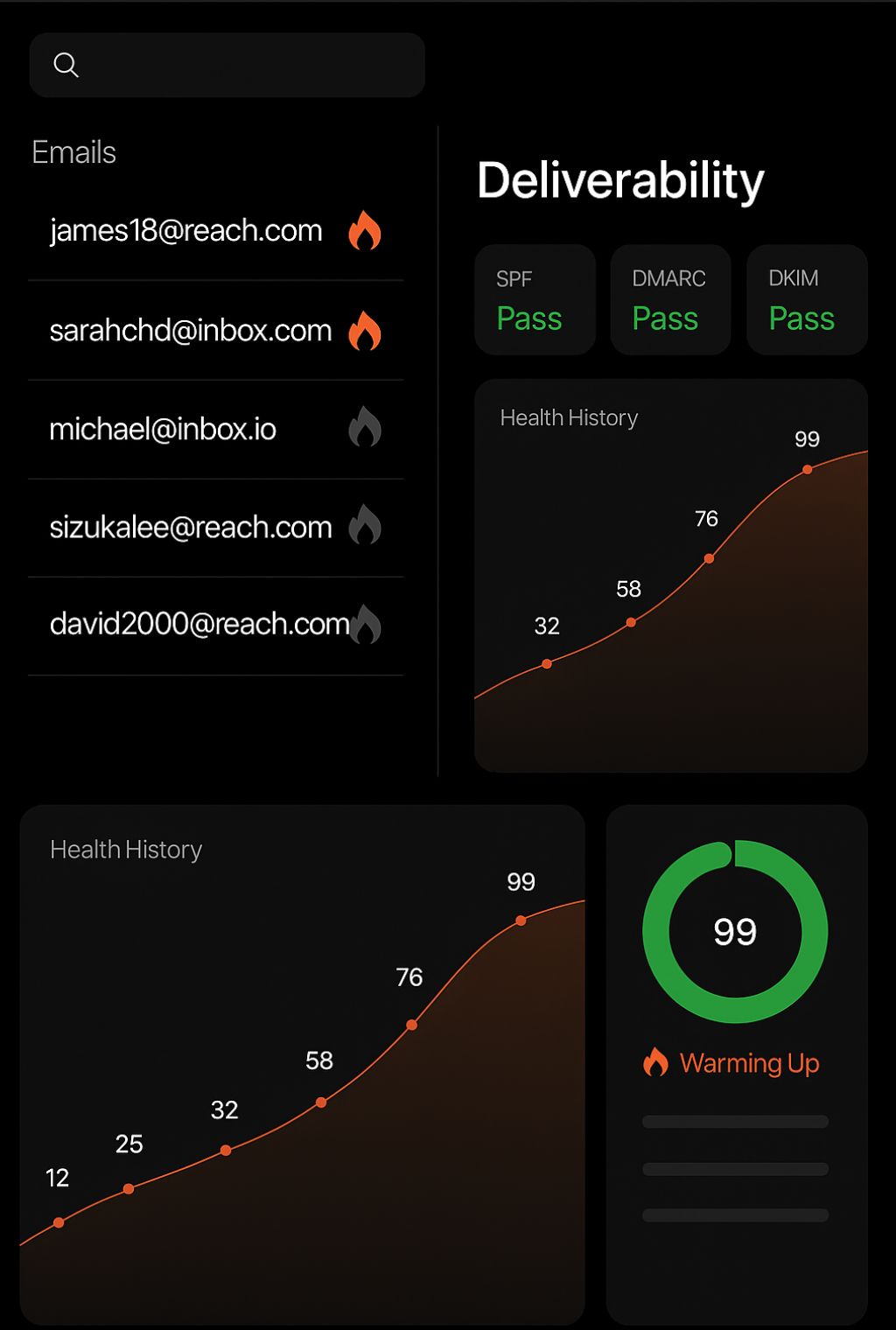

We Don't Rely on Stale ZoomInfo Lists

Most agencies buy generic contact databases and spray emails. We build custom prospect lists using multiple data sources, verify every contact manually, and segment by employer size, funding model, current virtual care adoption, and benefit consultant specialization. Your outreach hits decision-makers who actually control budgets - not outdated contacts from 2019.

Multi-Stakeholder Campaign Design

Virtual care deals involve brokers, HR leaders, CFOs, and benefits committees. We don't just email one contact and hope - we orchestrate campaigns that engage every decision-maker simultaneously, building internal consensus while your sales team focuses on closing.

You Get Strategy, Not Just Campaign Execution

Most agencies are order-takers: "Give us a list and messaging, we'll send emails." We build your entire go-to-market strategy - ICP definition, value prop positioning, competitive differentiation, objection handling, and multi-touch sequencing. You're not outsourcing tasks, you're gaining a strategic partner who understands how virtual care platforms win market share.

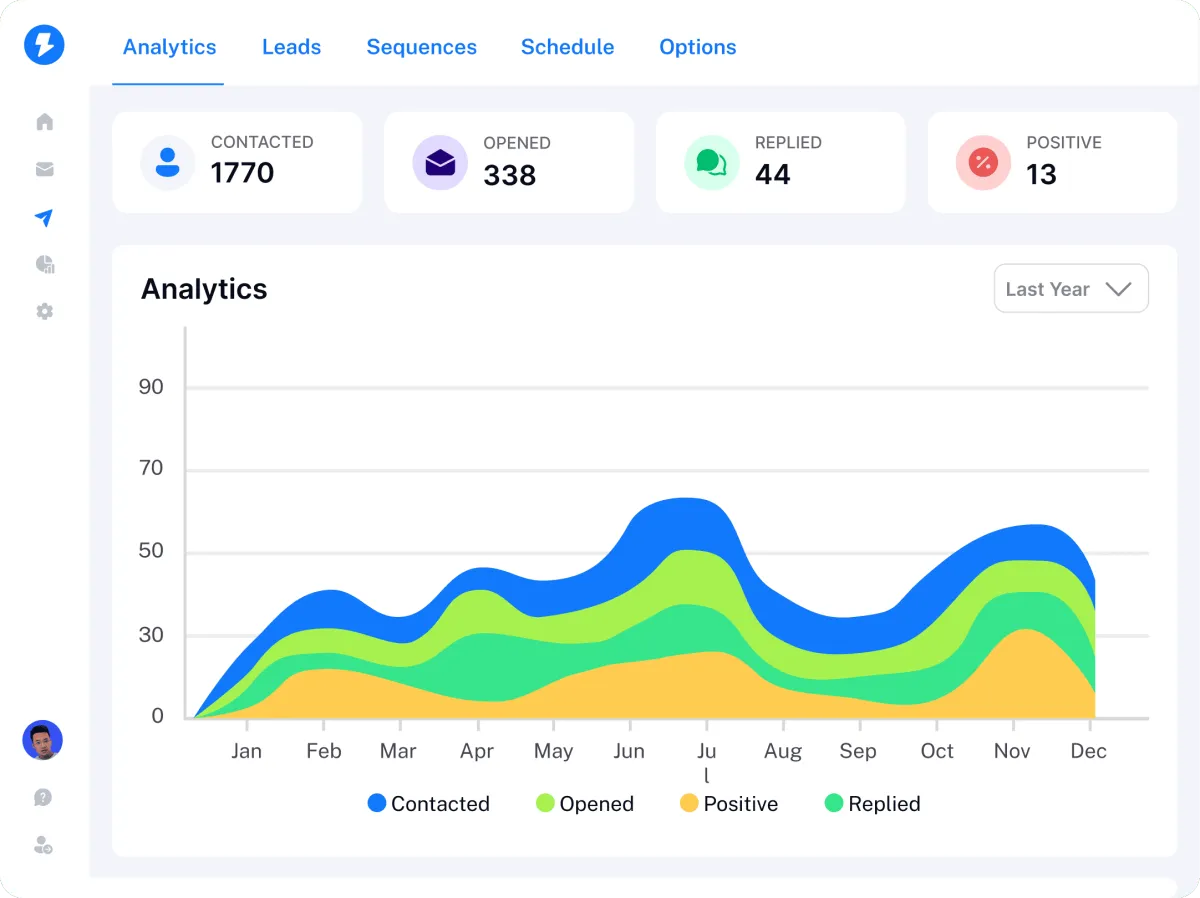

Proven Systems That

Deliver Results

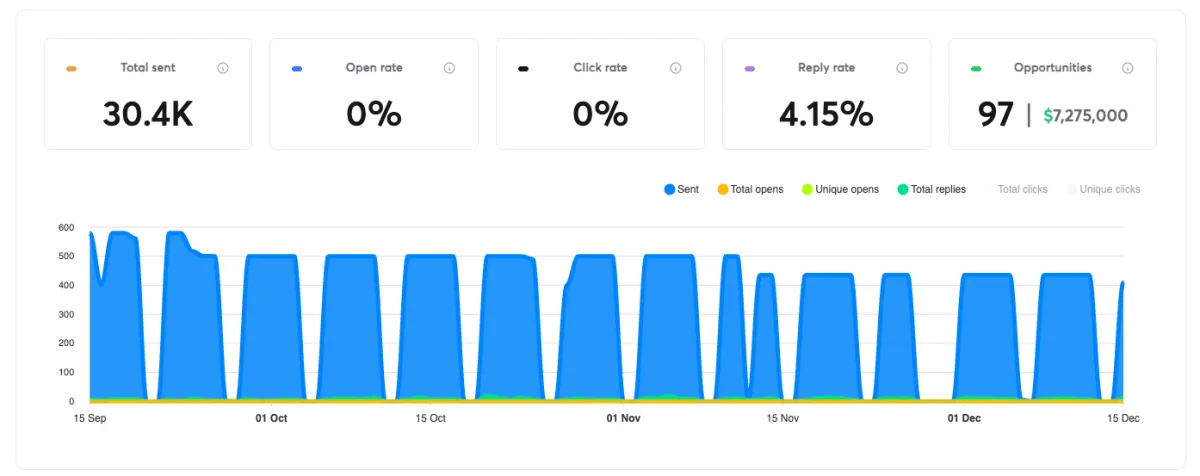

30k Emails sent / 97 Leads / $7.2M in Pipeline Value

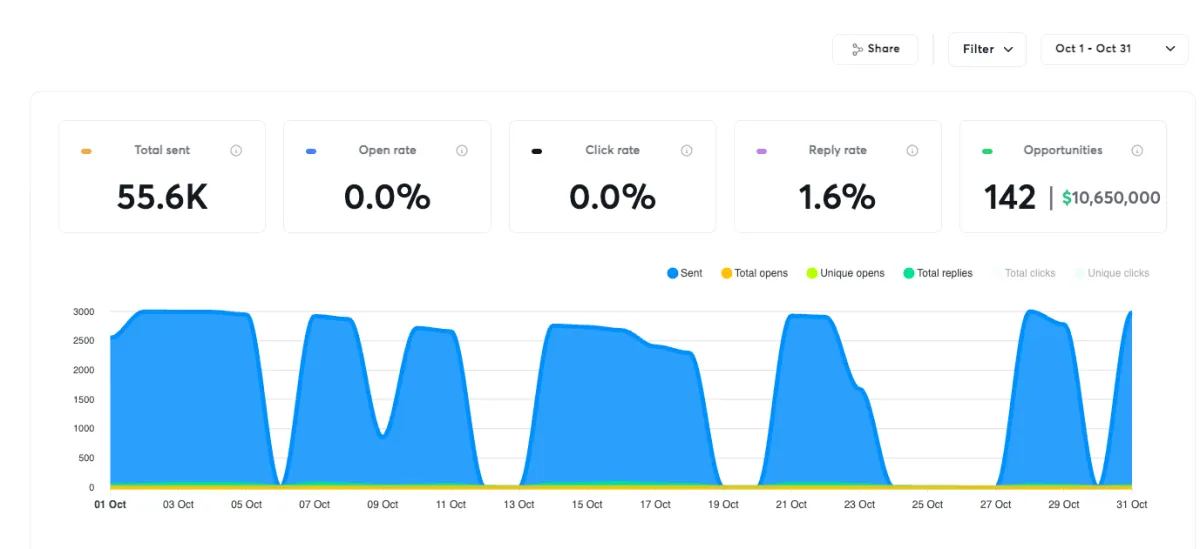

55k Emails sent / 142 Leads / $10.6M in Pipeline Value

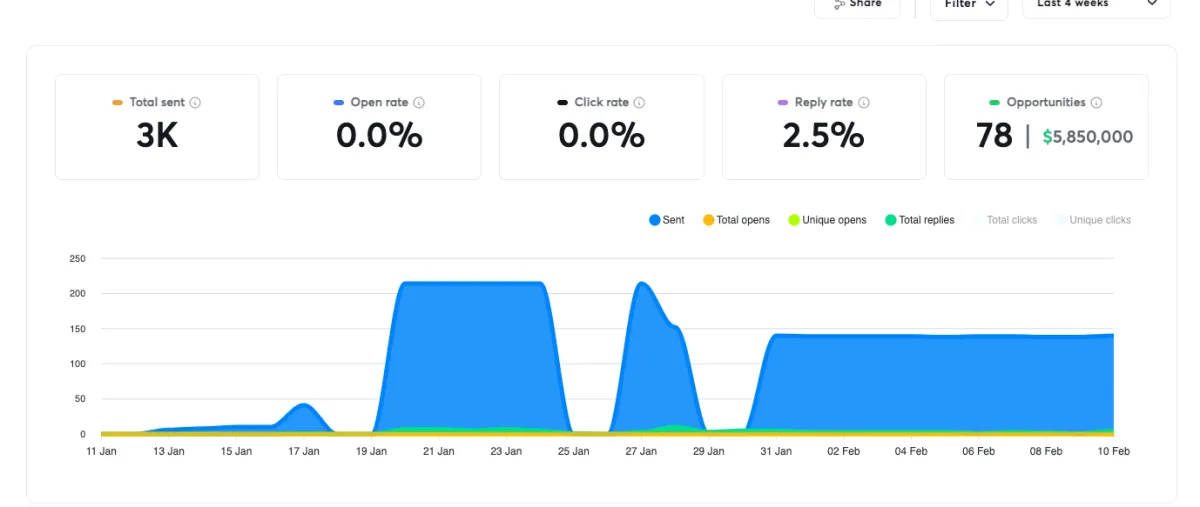

3k Emails sent / 78 Leads / $5.8M in Pipeline Value

106k Emails sent / 632 Leads / $47.6M in Pipeline Value

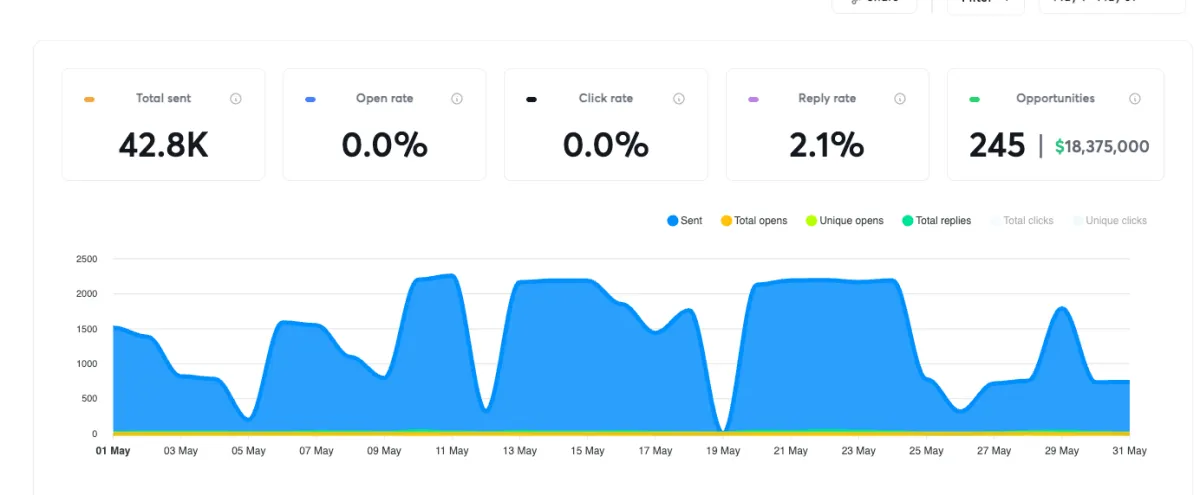

42k Emails sent / 245 Leads / $18.3M in Pipeline Value

©Copyright 2025. Hemets Advisory. All Rights Reserved.

Sebastian Hemetsberger. [email protected].+4369911267094